Notice: Norbord is now part of West Fraser. Click here to visit westfraser.com

Merchants’ May value sales down -5.2%, as volumes fall -7.0%

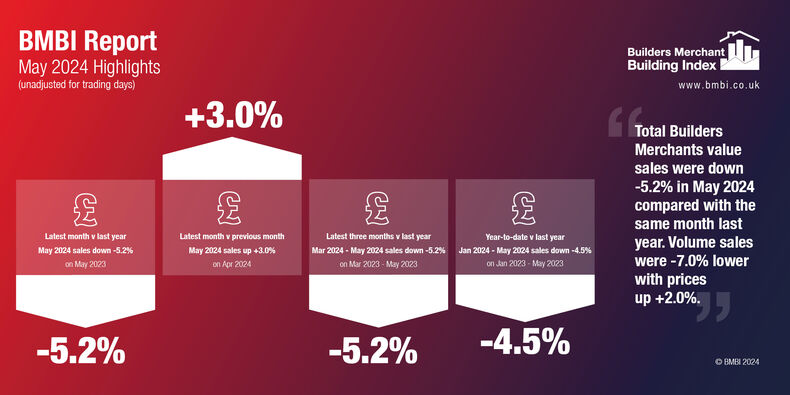

The latest Builders Merchant Building Index (BMBI) report, published in July, shows builders’ merchants’ value sales in May were down -5.2% year-on-year. Volume sales fell -7.0% and prices edged up +2.0%. With one more trading day this year, like-for-like value sales were down -9.7%.

Compared to May 2023, nine of the twelve categories performed better than Total Merchants year-on-year, with Workwear & Safetywear (+18.8%), Decorating (+3.7%) and Kitchens & Bathrooms (+2.0%) faring the best. Two of the largest categories – Timber & Joinery Products (-6.9%) and Heavy Building Materials (-7.7%) – declined more than Total Merchants. Renewables & Water Saving was the weakest category (-37.1%).

May total value sales were +3.0% higher than April. Volume sales increased +2.2% and prices were marginally higher (+0.8%) month-on-month. Half of the twelve categories sold more, with two of the largest categories – Landscaping (+12.7%) and Heavy Building Materials (+3.7%) – leading the pack. Plumbing Heating & Electrical (-5.8%) and Renewables & Water Saving (-18.4%) sales contracted the most.

In the 12 months from June 2023 to May 2024 total merchant sales were -4.5% lower than the same period the year before (June 2022 to May 2023). Volume sales slumped -8.9% while prices rose +4.8%. With six extra trading days in the most recent 12-month period, like-for-like value sales were down -6.8%. Workwear & Safetywear (+9.5%), Decorating (+7.1%) and Miscellaneous (+5.4%) did best. But two of the three largest categories – Heavy Building Materials (-5.4%) and Timber & Joinery Products (-10.2%) – sold less.

Total value sales from January to May were -4.5% down on the first five months of 2023.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report says: “May was positive for UK construction as better weather saw trades getting back on site. Monthly construction output returned to growth (+1.9%) after a fall in April, according to the latest ONS data. All bar one construction sector picked up in May, including new housing (+2.8%) although from a low base. However, growth in new build and residential RMI has yet to feed through to merchants, where volumes continued to fall.

“Perhaps with a new Labour government, pledged to build 1.5 million homes over the next five years, one that’s intent on tackling the backlogs and building bottlenecks with energy and determination, change will soon be felt in branches. Being realistic, a big uptick in volume looks some way off but, with both building and housing high priorities for the new Labour Government, we could be heading into a more sustainable and steady increase in demand with more stable pricing. Good news for all!”

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter. May’s BMBI report is available to download at www.bmbi.co.uk.

Request an A5 sample of any of our boards. Our samples come with an informative wraparound cover.

Request a sample